Aussie housing shift: Embracing vertical living in cities amidst challenges

The dream Aussie lifestyle has traditionally been synonymous with owning a home with lots of space. But Australia’s housing crisis is sparking a trend towards vertical living in its cities

Australian homes have long ranked among the most spacious in the world.

Having several bedrooms, a study, and a big backyard for entertaining guests around a barbecue is a common aspiration for most Aussies and one that has historically been easily attainable.

Yet the vision of the Australian dream home is disappearing amid a housing crisis that is forcing developers to build up rather than out.

In the suburb of Box Hill in Melbourne, the skyline is already being chiselled by hulking, multi-storey apartment blocks. Since development there took off a decade ago, the population has more than doubled, according to one local mayor, Mark Lane.

Dozens of glassy high-rise buildings have sprung up to cope with Melbourne’s population boom.

“We’re not making more land, so the only way is up,” Lane, who is the mayor at Whitehorse City Council in Box Hill, told ABC Australia.

In May last year, planning approval was granted for a proposed 51-storey tower in Box Hill, making it the tallest building in the state outside of Melbourne’s city centre.

Someone like me would need a lot of help from my parents. And it would still take more than ten years to save from a decent job. And even with those savings, I probably wouldn’t be able to live where I want to live

Some 5.5 hectares at Box Hill Central will be turned into a mixed-use and retail hub at a combined total investment of around AUD700 million. The tower will house around 600 residents and 2,000 workers and is 42% higher than any other building in the municipality.

The building marks just how much cities have changed in trying to adapt to the swell of young people and migrants who need a place to live.

In Sydney, a grassroots movement has emerged to fight opposition to higher density housing in gentrified inner-city areas.

Sharath Mahendran, a 21-year-old student who joined the Sydney YIMBY (Yes In My Backyard) group, says he could never afford the kind of freestanding home and 1,000- sqm plot his parents bought in the 1990s.

“Now someone like me would need a lot of help from my parents and then it would still take more than 10 years to save from a decent job. And even with those savings, I probably wouldn’t be able to live where I want to live. I’d live really far out.”

Australia’s housing crisis began about two decades ago after a 50 percent cut in capital gains tax and higher immigration.

Since the tax change came into effect in 1999, investors have been competing with those looking for a place to live, sending prices rising in comparison to incomes.

In the 14 months leading up to the summer of this year, interest rates in Australia rose 400 basis points, the fastest tightening in a generation, with prices rising further consequently.

As of the start of October, house prices were on track to reach record highs: The median price of a home was now AUD1,110,660 in Sydney, AUD776,716 in Melbourne and AUD691,591 in Adelaide, according to housing data company CoreLogic.

“We’ve seen the recovery of Australia’s housing market now move into its third quarter of growth for house prices and its second quarter of growth for unit prices,” one real estate analyst told ABC.

She added that prices were expected to continue to grow next year but at a slower pace.

While that might offer some hope for those looking to buy, buying a home in the main cities is a distant possibility for the vast majority amid such little supply.

In recent months, the government has been pushing the idea of multi-storey housing as a solution.

Prime Minister Anthony Albanese said the government was “promoting medium and high-density housing in well-located areas close to existing public transport connections, amenities, and employment and streamlining approval pathways”

The government’s target is to build 1.2 million homes in five years, offering AUD3 billion in cash bonuses to states to build more homes than they have committed to. In New South Wales, higher and denser development is being allowed if developers allocate 15 percent to affordable housing.

“This will incentivise states and territories to undertake the reforms which are necessary to boost housing supply and housing affordability,” says Albanese.

Yet experts don’t see the rise in supply alone as a silver bullet to the country’s housing problems.

With much of the higher density being buildto-rent, expected rent hikes are going to make life tough even for tenants.

Suburbtrends, a data analytics company specialising in affordable housing solutions, has said many tenants could face increases of over AUD100 per week by next year due to the housing shortage.

There is also opposition from residents who say high-rises block out their light and view, and from politicians who don’t want higher density at the expense of community facilities and parkland.

Immigration, too, has become a contentious issue as regards to housing.

“The role of high immigration levels (now about 500,000 per annum) can’t be ignored. On our estimates, it needs to be cut back to nearer 200,000 people a year to line up with building industry capacity and to reduce the supply shortfall,” says Shane Oliver, chief economist at AMP Investments.

Benson Zhou, a director at Savills, says the market faces a dilemma.

“Build-to-rent are my best clients now. They are the only developers buying properties like high-density flats. They’re paying premium dollars,” says Zhou.

“However, that is not solving the affordability problem. Why? Yes, they are providing more accommodation, but they are charging people to pay more than the market rent.”

This article was originally published on asiarealestatesummit.com. Write to our editors at [email protected].

Recommended

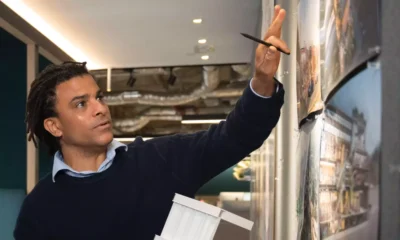

Meet the architect transforming Asia’s retail spaces with nature-inspired designs

David Buffonge, the cofounder of Hong Kong-based Lead8, has strong opinions on how to improve built environments around Asia

6 sights to check out in Siem Reap, Cambodia

Cambodia’s “temple town” is bolstering its touristfriendly attributes with new infrastructure and residential developments

Inside Asia’s luxury resort residences that are redefining high-end living

Asia’s resort residence market is witnessing a shift as investors eye larger, multifunctional units

How joining BRICS could give Thailand and Malaysia a new economic edge

Thailand and Malaysia are eyeing membership in the bloc of emerging nations