Asia Pacific real estate transaction volume hits an all-time high, accumulating $128 billion

With China leading the pack, claiming a 56 percent sales increase throughout the first three quarters of 2019

The Asia Pacific region has reached a record high USD128 billion on commercial real estate transaction volumes, reported The Business Times, citing data published by JLL.

Since July to September, the sales activity rose by 18 percent year-on-year to USD42 billion, which represented the best third-quarter performance to date.

Among the markets, China experienced high transaction volumes, coming in third globally after Paris and London. In Shanghai, the investments amounted to USD14.4 billion year-to-date. During the first three quarters of the year, this city was also the biggest beneficiary of cross-border investments at 56 percent compared to the rest of the cities in the region.

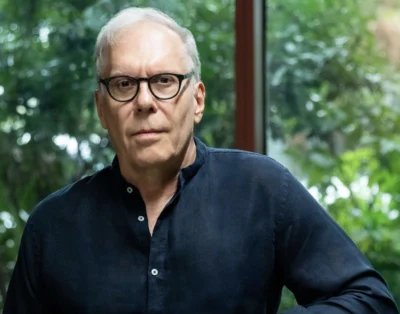

“Investors in Asia Pacific are seeing past current headwinds such as slowing growth and trade tensions,” said Stuart Crow, CEO of Asia Pacific Capital Markets, JLL.

“Liquidity has strengthened in markets such as Seoul, Tokyo, and Singapore, where occupier fundamentals remain solid. We are expecting Asian investors to further diversify their real estate holdings within the region and globally in the months ahead as they seek higher yields.”

More: Asia Pacific’s hotel investments will surpass the $11 billion threshold in 2019

The increase was also partly driven by Singapore’s strong recovery where year-to-date transactions are at its peak. Its office market has witnessed a growing investment volume of over 175 percent, encouraged by the robust rental growth and net absorption.

On the other hand, Asia Pacific markets were recorded as the largest capital sources for cross-border investment in the first nine months of 2019.

“Asian investors are spreading their capital more broadly and are looking at markets such as continental Europe where debt costs are low, assets are available and markets, such as Germany and France are seen to be beneficiaries post-Brexit,” said Crow.

Recommended

Asian infrastructure investments boost real estate and economic growth

Governments around Asia are spending billions to fuel infrastructure development to boost real estate and economic growth

Arquitectonica’s global impact reshapes skylines from Miami to Asia

Bernardo Fort-Brescia and his design practice Arquitectonica are making a seismic impact in Asia from an HQ in Florida

Park Kiara in Hanoi raises the bar for sustainable urban living

Park Kiara in Hanoi is a repudiation of low-density, car-dependent suburban sprawl

6 reasons Bekasi is rising as Greater Jakarta’s next hotspot

One of Greater Jakarta’s rising stars is prospering, thanks to ample recreation and a contingent of desirable housing projects