Major land deal signals Thailand as a global data centre leader, and other updates

For PropertyGuru’s real estate news roundup, Thailand emerges as a hub for digital infrastructure in Southeast Asia, thanks to the increasing demand for high-quality data centre facilities. In other reports, tourism and wage growth are shaping Japan’s retail sector while other Asian markets show steady performance and resilience. Lastly, part one of the Santos Knight Frank report on Metro Manila as the most preferred location for growth and expansion.

Thailand emerges as Global Data Centre powerhouse after landmark deal by JLL

JLL Thailand, a global real estate consultant has successfully facilitated a major real estate transaction, securing prime land along Bangna-Trat Road for one of the world’s largest digital infrastructure companies. JLL’s global connectivity, comprehensive database, and insightful market knowledge enabled a seamless transaction process, ensuring optimal outcomes for all parties involved.

The transaction on Bangkok’s Bangna-Trat Road further reinforces the strategies of many data centre operators to invest in Thailand based on the country’s readiness to serve as a digital hub, the growing demand for data centre services, and the government’s supportive policies, including the Cloud First Policy initiative. Thailand’s Board of Investment (BOI) has also approved the long-term investment, recognizing its potential to bolster the nation’s digital infrastructure.

Numerous factors support Thailand’s emergence as a regional data centre hub. Powered by a high internet penetration rate of over 85% and the presence of social media user identities exceeding 65% indicate strong fundamental potential for the data centre business in the country. In addition, the planned investment of USD 500 million from one of the world’s largest digital infrastructure companies confirms Thailand’s position as a hot data centre destination in Southeast Asia.

Mr. Krit Pimhataivoot, Head of Capital Markets at Jones Lang LaSalle (Thailand) Limited (JLL), commented on the landmark deal, stating in RETalk Asia: “The increasing demand for high-quality data centre facilities in Thailand demonstrates the country’s growing importance as a hub for digital infrastructure in Southeast Asia. Data Centre is a highly risk-averse business where site selection criteria are highly detailed aiming to mitigate risks from all angles. We are delighted to have played a crucial role in facilitating the successful transaction of this prime plot.”

Japan the booming outlier in Asia Pacific’s major retail markets

Tourism and wage growth have boosted Japan’s retail sector, however, other developed Asian markets have demonstrated steady performance and resilience.

Simon Smith, Head of Research & Consultancy, Asia Pacific at Savills, says: “The diversity of retail real estate markets across the region makes it almost impossible to generalise, however, all are demonstrating how tourism can boost retail. Most retail markets are stabilising after the challenges of e-commerce and the pandemic. Future supply is muted in several cities, and this is sparking investor interest. One interesting phenomenon is the success of cheaper retail destinations which are close to more expensive markets and thus benefit from short-hop tourists looking for better value.”

Retail rents continued to fall in the third quarter across the first-tier cities of China and the luxury retail sector continues to struggle as it is expected to shrink as much as 15 percent this year.

However, the sector is showing some signs of resilience. Vacancy rates in Shanghai, Beijing and Guangzhou rose only marginally, while Shenzhen saw vacancy fall, in the third quarter. New fast fashion and entertainment brands continue to emerge around the country and there are still a few overseas retailers opening new stores. Meanwhile, local and national government support measures are expected to aid the retail sector.

The headline story for retail in Japan is the boost from tourist spending, however strong wage growth is boosting domestic consumption. Furthermore, the weak Yen means more Japanese tourists are staying and spending at home. Regional Japanese cities are seeing strong rental rises, 5.9 percent overall in the first half of this year. Tokyo has seen new flagship stores opened by brands including Rolex and Balenciaga.

Manila remains the No. 1 location for expansion: Santos Knight Frank survey (Part 1)

The Philippine office sector is expected to continue its rebound trajectory in 2025 as tenants express optimism regarding their office expansion and right-sizing plans over the coming years, according to global real estate services company Santos Knight Frank.

Santos Knight Frank’s recent occupier sentiment survey, The Collab, revealed 64 percent of companies surveyed see potential expansion in their office footprint in the next 3-5 years. One in every three indicated choosing Metro Manila as their preferred location for growth.

Overall, the commercial real estate sector has been thriving in 2024, fueled by outsourcing expansion and leasing activity. Despite limited supply in high-end and prime real estate, the sector continues to show stability and growth amid evolving market challenges.

Rick Santos, Chairman & CEO of Santos Knight Frank says: “The Philippine real estate sector is riding on a wave of opportunities driven by proactive measures from the current administration to open the country further to investments. These efforts are creating a more dynamic and business-friendly environment, paving the way for sustained development and progress.”

“Momentum in the market remains strong, particularly in the residential segment, where Manila has once again secured the top spot in Knight Frank’s Prime Global Cities Index. Demand continues to drive price growth in this sector, fueled by limited supply,” Santos adds.

He continues: “At the same time, the preference for green-certified buildings is on the rise, signalling a shift among occupiers toward highly efficient, sustainable, and cost-saving grade-A buildings. This year, we saw a 5 percent increase in green-building take-up. The shift from traditional to green-certified spaces can also imply their real estate strategy in their flight to quality. The Marcos administration’s CREATE MORE Act promotes investment-friendly policies designed to stimulate business growth and demand for real estate. With these reforms, Manila presents a prime opportunity for investors to capitalize on its expanding commercial and industrial sectors.”

(TO BE CONTINUED)

The Property Report editors wrote this article. For more information, email: [email protected].

Recommended

Thailand’s real estate sector watches closely as the Shinawatras return to power

Time will tell if the return to power in Thailand of the Shinawatras will lift the country’s ailing real estate sector

China’s homebuying surge: Can new stimulus measures keep the market rally alive?

Stimulus measures have sparked a surge in homebuying activity around China, but many are sceptical the shift will endure

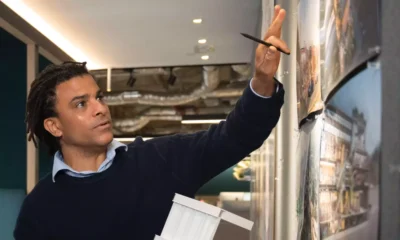

Meet the architect transforming Asia’s retail spaces with nature-inspired designs

David Buffonge, the cofounder of Hong Kong-based Lead8, has strong opinions on how to improve built environments around Asia

6 sights to check out in Siem Reap, Cambodia

Cambodia’s “temple town” is bolstering its touristfriendly attributes with new infrastructure and residential developments