Vietnam is APAC’s most promising residential property market, plus additional news

For PropertyGuru’s real estate news roundup, Vietnam’s residential property market stands out within the region’s luxury real estate sector. In other reports, the UAE real estate market maintains strong momentum and robust activity across all sectors in the third quarter of 2024. Lastly, “strong economic fundamentals and a diverse range of lucrative asset classes” will attract more international and local investors to Asia Pacific real estate markets in 2025, according to Colliers.

Vietnam’s real estate market among most promising in Asia-Pacific: Knight Frank

Vietnam’s residential property market has captured the attention of High-Net-Worth Individuals (HNWIs) and investors, driven by strong GDP growth, urbanisation, and its strategic role in the “China+1” strategy, according to Knight Frank’s report cited in VietnamPlus.

The Asia-Pacific Horizon Report Part 4, “Quality Life-ing: Mapping Prime Residential Hotspots,” released on November 25, positions Vietnam as a standout market within the region’s luxury real estate sector. The report evaluates 15 markets based on five indicators—Economy, Human Capital, Quality of Life, Environment, and Infrastructure and Mobility—guiding investors and prospective movers in choosing ideal locations.

With a 6.1 percent GDP growth forecast in 2024, Vietnam stands as the second-fastest-growing economy in the region, just after India, signalling a robust trajectory for its real estate sector.

The average selling price for high-end apartments in Ho Chi Minh City and Hanoi ranges from USD5,400 to USD15,000 per sq.m, aligning with global markets but offering significant growth potential. The ongoing development of highways, metro systems, and airports is enhancing connectivity and property values in emerging urban areas.

UAE real estate market set for growth in Q4 2024 as demand surges for prime assets

The UAE real estate market defied global headwinds in the third quarter of 2024, maintaining strong momentum and robust activity across all sectors. High transaction volumes and an upward trajectory underscore the market’s resilience, fueled by strong economic fundamentals.

According to JLL’s latest UAE Market Dynamics report, a surge in transaction volumes for off-plan properties, which recorded a 50.3 percent annual growth in Q3, set the pace for the upward swing in Dubai’s residential market with sales transactions rising 35.6 percent year-to-date.

“The UAE real estate market demonstrates remarkable resilience, achieving robust growth across all sectors despite a challenging global outlook. Investor confidence remains strong in Dubai and Abu Dhabi, and this upward trajectory is expected to continue, driven by strategic government initiatives and the ongoing development of world-class destinations,” stated Taimur Khan, head of research MEA at JLL, as mentioned in the Economy Middle East article.

Investor optimism fuels APAC real estate revival in 2025 – Colliers

Leading global diversified professional services company Colliers has launched its 2025 Global Investor Outlook, finding renewed investor optimism and confidence that the commercial property market has moved past an inflexion point following two years of muted transactions.

The associated Asia Pacific Report: 2025 Global Investor Outlook reveals a local investment landscape gearing up for a lower interest rate environment in many markets, following a prolonged inflationary period that kept many investors on the sidelines. Expectations of rate cuts and factors such as continued narrowing of pricing and valuation gaps are expected to help drive transaction volumes in the APAC region.

“Strong economic fundamentals and a diverse range of lucrative asset classes will draw a growing number of international and local investors to Asia Pacific real estate markets in 2025,” said Chris Pilgrim, Colliers’ Managing Director of Global Capital Markets, Asia Pacific, in the RETalk Asia report.

“Optimism is rising in the APAC real estate market as interest rate cuts pave the way for increased transactions. With a narrowing pricing gap and growing investor interest in sectors like office and logistics, 2025 promises significant opportunities for cross-border investments and renewed market activity.”

The Property Report editors wrote this article. For more information, email: [email protected].

Recommended

Thailand’s real estate sector watches closely as the Shinawatras return to power

Time will tell if the return to power in Thailand of the Shinawatras will lift the country’s ailing real estate sector

China’s homebuying surge: Can new stimulus measures keep the market rally alive?

Stimulus measures have sparked a surge in homebuying activity around China, but many are sceptical the shift will endure

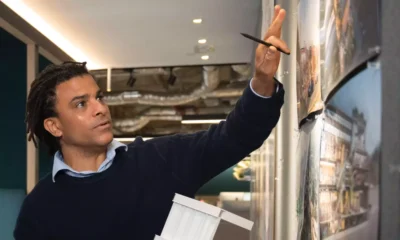

Meet the architect transforming Asia’s retail spaces with nature-inspired designs

David Buffonge, the cofounder of Hong Kong-based Lead8, has strong opinions on how to improve built environments around Asia

6 sights to check out in Siem Reap, Cambodia

Cambodia’s “temple town” is bolstering its touristfriendly attributes with new infrastructure and residential developments