Ingrained Chinese work culture: The solution to Beijing’s office oversupply

Beijing’s chronic oversupply of office space has been exacerbated by the pandemic, but the country’s work culture suggests that demand will eventually catch up

In 2009, a year after the onset of the global financial crisis and China hosting the Olympics, Beijing’s Planning Exhibition Hall proudly displayed scale models of what would be the Chinese capital’s future finance hub.

Named Lize financial district, this area of just over 8.09 square kilometres aimed to help Beijing challenge Shanghai’s status as the business capital of China. Architectural plans included rows of shiny skyscrapers, dedicated green space to tackle the city’s smog, and a new subway line, all with a target completion date ahead of the then futuristic-sounding year of 2020.

Although largely on track, with enduring delays to some key projects, Lize has come to represent a long term office oversupply problem brewing in Beijing which reached crisis levels as Covid-19 struck China at the end of 2019.

By the third quarter of last year, Lize was showing signs of post-pandemic recovery as absorption rates increased, according to Savills data. But vacancy rates have remained at a staggering 55.8 percent, and as office towers in Lize have reduced rents, the district has begun to cannibalise office demand from Beijing’s other key business districts where rents have remained higher.

The central business district saw vacancy rates climb by more than 3 percent to nearly 17 percent in the third quarter, according to Savills, despite signs of a recovery in the wider real estate market in Beijing and across China.

“The citywide office market is under substantial pressure due to the abundant new supply and slower absorption, even as Covid-19 was effectively contained and market demand resumed to some extent,” says Vincent Li, associate director for Northern China at Savills.

For years, Beijing’s office market had been characterised by soaring rents which propelled China’s capital to rank as the third most expensive office market in the world behind only Hong Kong and New York. But by last summer, China’s capital had witnessed a fundamental shift from a market characterized by supply—and associated policy restrictions—to demand “becoming the primary market driver”, according to JLL.

This has been a trend long in the making. Office rental prices peaked in 2018, and since then oversupply has caused a steady fall in rents further exacerbated by the global pandemic which led to a decade high in vacancy rates and rent reductions last year, says Colliers director of research for Northern China, Ming Lu.

“The pandemic has seriously inhibited the release of office demand among enterprises, and the actual annual net absorption has set a record low,” Ming says.

Vacancy rates in office buildings across Beijing hit nearly 20 percent last year, and the real ratio measuring supply versus demand soared to 21 times following the pandemic, according to Colliers. “This shows that the imbalance between supply and demand in the Beijing market is very serious under current market conditions,” adds Ming.

Amid seemingly endless television news reports suggesting Covid-19 may have irrevocably changed how we work, the key question is: will the office market ever recover to pre-pandemic levels?

Although the likes of Colliers and CBRE published new research into working from home for China and the wider Asia-Pacific region even before Covid-19, most international agencies predict a recovery in the office market in the medium term.

Culture will play a key role. Although the Chinese central government ordered office workers to stay at home for nearly four months at the start of 2020 in a relatively successful bid to contain the pandemic, there are no signs of a widespread fundamental shift in work culture in China’s capital, according to James MacDonald, head of Savills Research China.

We can say home working is still a supplement to office working. The traditional notion of office working is deeply rooted in the hearts of people [in China], and there will be no significant substitution effect in the short term

“Beijing’s measures have generally been more prolonged and stricter than many other cities given the secondary outbreak in June and July,” he says. “The impact on business activity has therefore been more notable [in Beijing versus other Chinese cities] though I don’t feel the impact on how companies use office space over the long term will be any different.”

After Chairman Mao Zedong took over the ‘New China’ at the midway point of the previous century, Chinese lived and worked in danwei, or work units where the home and place of work were kept entirely separate, often in the same wider compound. After reforms of the economy in the 1980s, the geographical space between the home and workplace became wider as many Chinese began the daily office commute commonly seen in the west.

“We can say home working is still a supplement to office working,” says Ming of Colliers. “The traditional notion of office working is deeply rooted in the hearts of people [in China], and there will be no significant substitution effect in the short term.”

Most analysts predict a complex picture for Beijing’s office market. Lize is expected to be the first district in Beijing to adopt 5G internet wholesale, making it yet more attractive for would-be tenants. Conversely, the provision of faster internet into the city’s apartments further establishes home working as a viable alternative to the office.

Then again, online education companies have boomed in recent years in China—particularly during the pandemic—and have become among the leading grouping of new tenants in many Chinese cities, including Beijing but also Chongqing and Xian further west, according to Savills.

As ever, government policy remains a key factor. In September, President Xi Jinping announced that the Chinese capital would become a new free trade zone focusing on the digital economy and services sector.

In 2019, the government announced that wealth management firms were set to spin off from the large state-owned banks, and these new entities have since quickly taken up new offices in the capital.

Deregulation of the financial sector “allowing greater participation in life insurance, futures, funds, and securities by foreign firms” has meant many are flooding into the market and taking up new offices, including a local joint venture with the world’s largest insurance firm Allianz.

Although 2021 will be “a very challenging year” for the office sector in Beijing, according to Ming of Colliers, many analysts are more optimistic for the end of the year and beyond. Grade-A office rents are expected to now trough in 2022 and only then recover, according to JLL.

“Despite the present downturn, investors are still keen on Beijing’s office market as it bodes well for the long-term,” said Yang Mi, head of research for Northern China at JLL. “Covid-19 has allowed unanticipated opportunities for market entry for investors and tenants picking up space at a softer rent.”

The original version of this article appeared in Issue No. 164 of PropertyGuru Property Report Magazine

Recommended

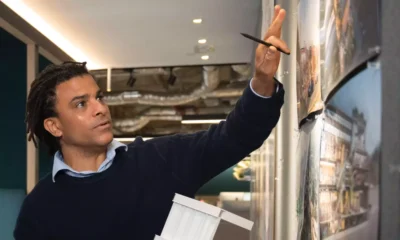

Meet the architect transforming Asia’s retail spaces with nature-inspired designs

David Buffonge, the cofounder of Hong Kong-based Lead8, has strong opinions on how to improve built environments around Asia

6 sights to check out in Siem Reap, Cambodia

Cambodia’s “temple town” is bolstering its touristfriendly attributes with new infrastructure and residential developments

Inside Asia’s luxury resort residences that are redefining high-end living

Asia’s resort residence market is witnessing a shift as investors eye larger, multifunctional units

How joining BRICS could give Thailand and Malaysia a new economic edge

Thailand and Malaysia are eyeing membership in the bloc of emerging nations